does kansas have an estate or inheritance tax

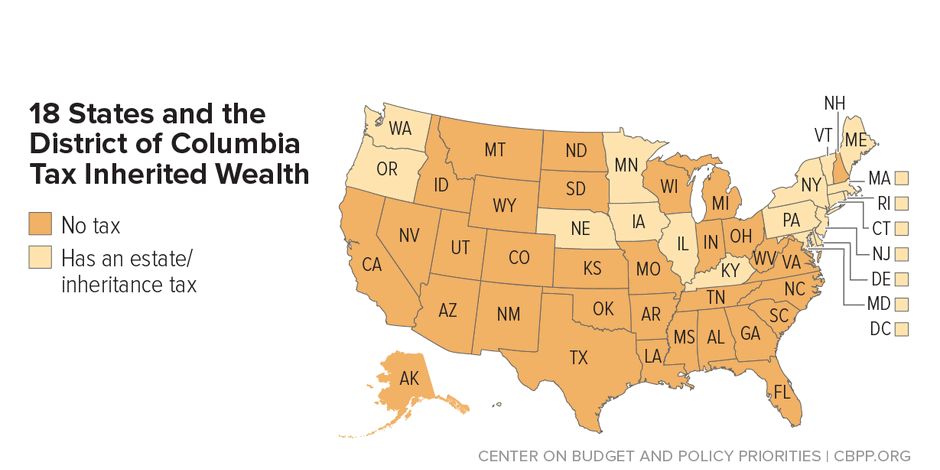

Here S Which States Collect Zero Estate Or. But 17 states and the District of Columbia may tax your estate an inheritance or both according to the Tax Foundation.

However the federal estate tax exemption was recently raised to a threshold of 112 million for an individual and double this amount for a couple.

. Skip to content 248 613-0007. This is known as the Inheritance Tax. Unlike an inheritance tax New York does have an estate tax.

The ohio estate tax was repealed. The fact that oklahoma does not have an inheritance tax means that the states resident does not have to pay any taxes when they. The estate tax is paid by the estate whereas the inheritance tax is levied on and.

Utah does not have an estate or an inheritance tax. Individuals should also file state and federal. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

The inheritance tax applies to money or assets after they are. Unlike an inheritance tax New York does have an estate tax. Not every state imposes the Inheritance Tax and South Carolina is one of many that does not.

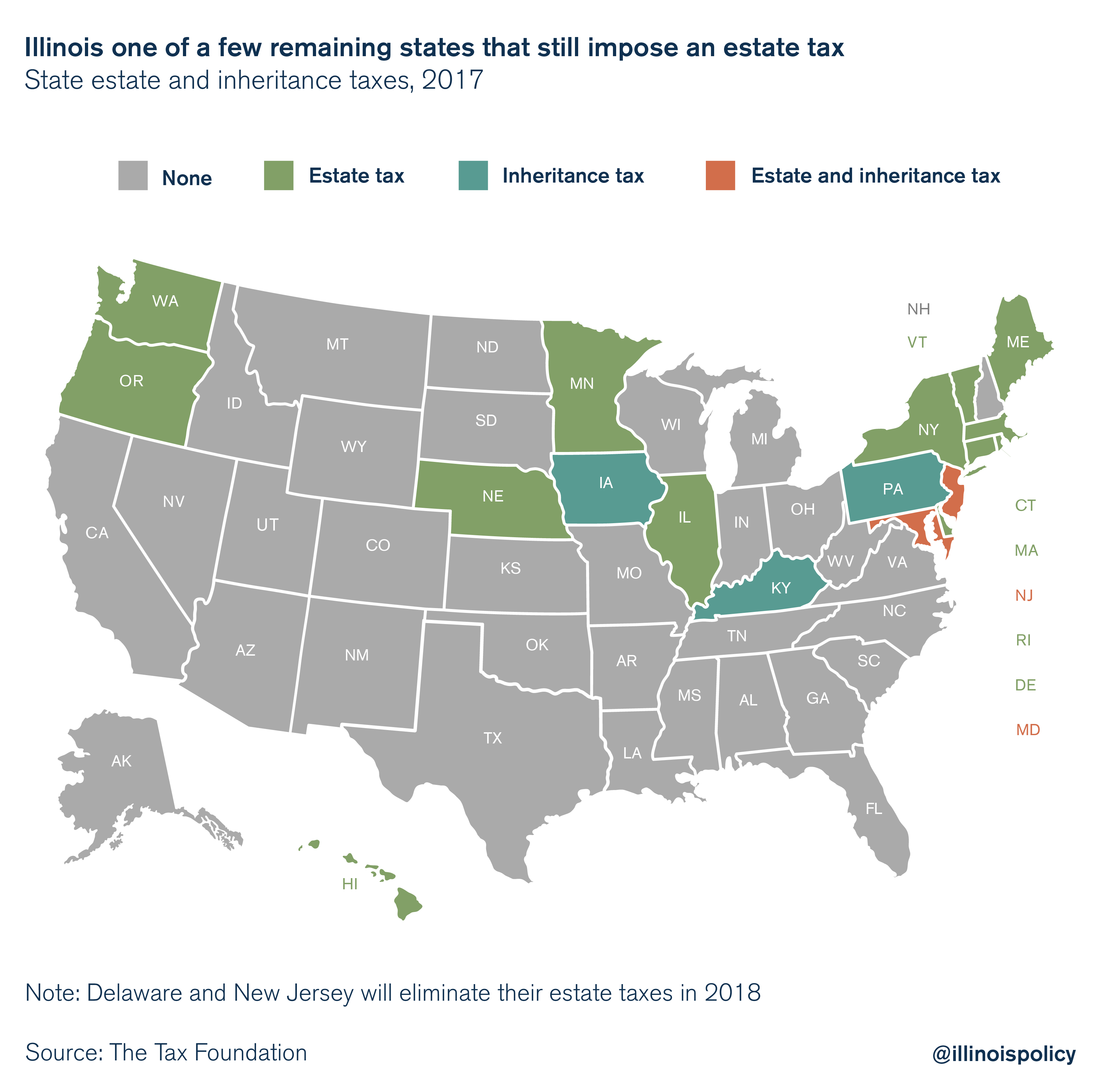

Which states have a state inheritance tax. By Sarah Fisher. The estate tax is not to be confused with the inheritance tax which is a different tax.

South Carolina also does not impose an Estate Tax. However if you receive an inheritance from another state you may be. Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year from the.

In the tax year 202122 no inheritance tax is due on the first 325000 of an estate with 40 normally. Many people who are Estate Planning or have had someone die usually have questions about Michigan Inheritance Tax and if they have to pay it. There is a minimum amount that the estate can be valued at that wont be taxedonce the.

Does Kansas Have an Inheritance or Estate Tax. Hi does kansas have an inheritance tax. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware.

In this detailed guide of the. As a result wealthy entrepreneurs may pass. The state sales tax rate is 65.

These states have an inheritance tax. The state of Kansas does not place a tax on estates or inheritances. New Yorks estate tax.

The size of the inheritance. Washington states 20 percent rate is the highest estate tax rate in the nation. A 1 million estate in a state with a 500000 exemption would be taxed on 500000.

Is There An Inheritance Tax In Kansas Estate Planning Attorneys In Missouri And Kansas

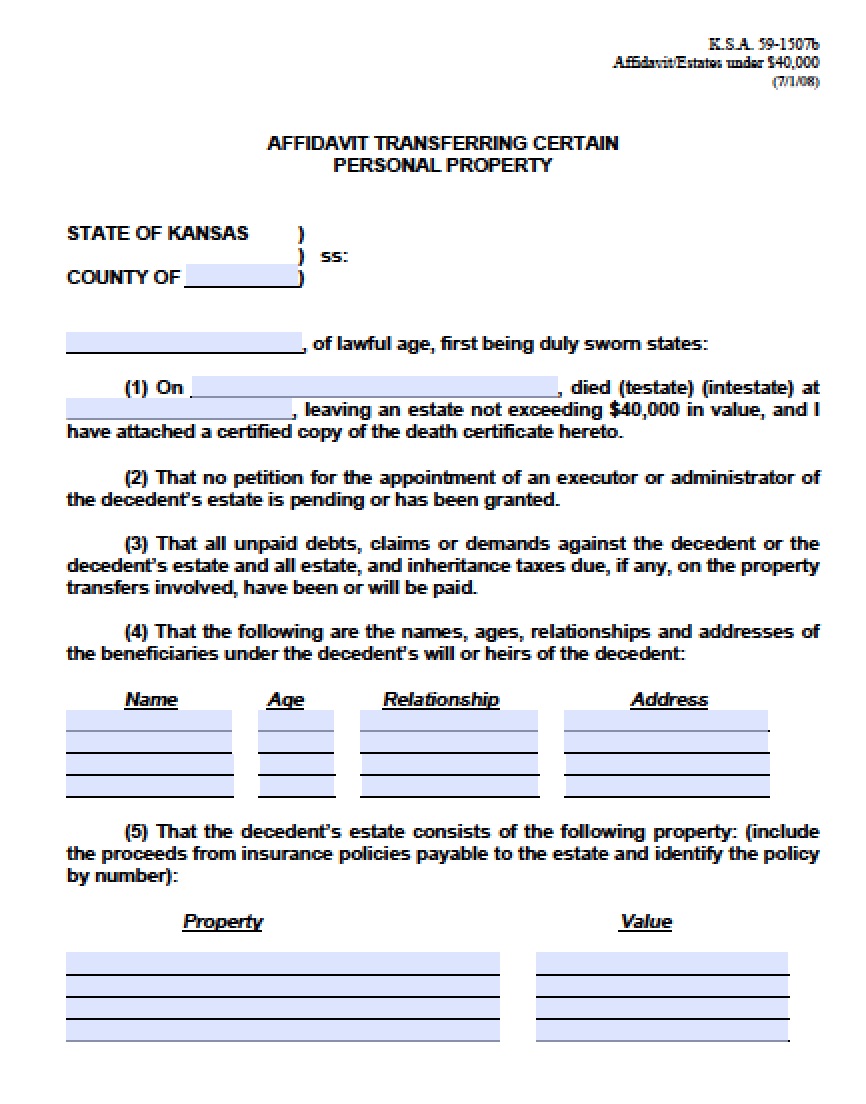

Free Kansas Small Estate Affidavit Form Pdf Word

Does Kansas Charge An Inheritance Tax

State Estate And Inheritance Taxes Itep

State Estate Taxes A Key Tool For Broad Prosperity Center On Budget And Policy Priorities

:max_bytes(150000):strip_icc()/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated And Who Pays It

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group

Kansas Retirement Tax Friendliness Smartasset

As Other States Repeal Illinois Death Tax Remains

States With Inheritance Tax Or Estate Tax Bookkeepers Com

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

Death And Taxes Nebraska S Inheritance Tax

Map Does Your State Have An Estate Or Inheritance Tax

The Difference Between An Estate Tax And An Inheritance Tax Ohall Kemper Law

Estate Taxes Are A Threat To Family Farms

State By State Comparison Where Should You Retire